Refinancing Credit Cards – Using Home Equity?

So people think of mortgages as good debt and credit cards as bad debt, but is it really that simple? It usually isn’t. Sure the idea of paying off debt that may have interest rates as high as 30% sounds great in theory, but there are some pitfalls when adding that debt into your mortgage.

Credit card debt is unsecured debt, but if you refinance you are converting that debt to secured debt. Remember, if you don’t pay your credit card debts, you probably won’t lose your house, but if you don’t pay your mortgage, you will definitely lose your house.

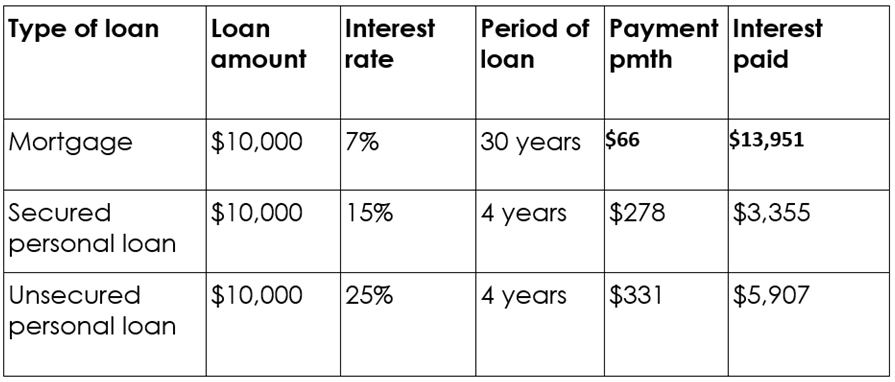

Refinancing costs may cost you more than the interest you are paying on the credit card debt. You may depending on your loan to valuation need a registered valuation. These can all add up quickly. So even though you are saving on the monthly interest rate by refinancing, look at what the true cost comparison is to your refinance cost.

Most mortgages are 15 to 30 years, are you really prepared to be paying off that vacation for that long? And if you look at the life of the loan, are you paying even more interest over time?

And let’s be honest, unless you are willing to completely stop using credit cards or change your spending habits, what is going to keep you from finding yourself right back in the same place in a few years. High balances on your credit cards, and now your home can’t help you out.

There are alternatives to refinancing your credit cards. For most, your home is your biggest investment, don’t put it at risk if you can help it.

At Bricks and Mortgages we can help you explore your options in one of our free consults. We offer a judgement free zone and are happy to help.